Unit Trusts

Abacus has introduced money market funds from Sanlam and Old Mutual on the platform. These funds are type of unit trust, and you can read more about them below.

What is a Unit Trust?

A Unit Trust fund is a collective investment scheme that pools money together from many investors who share the same financial objective, to be managed by a group of professional managers who invest the pooled money in investments such as shares, bonds and other investments. Collective Investment Schemes are arrangements made or offered by a company under which the contributions or payments made by the investors are pooled and invested to receive profits, income, produce or property, and the pool is managed on behalf of the investors by a professional manager. The manager uses the money to buy stocks, bonds, or other securities according to specific investment objectives that have been established for the pool.

In other words, a collective investment scheme such as a unit trust is simply a chama that pays a fee to a professional to manage the money they contribute and distribute the returns

What is a Money Market Fund?

A money market fund is a type of unit trusts that invests in low-risk investments with an element of guaranteed return such as fixed deposit accounts, treasury bills and commercial bonds (such as Centum bonds). This type of fund usually invests in money market instruments with a maturity of less than one year.

Money market funds are often regarded as being as safe as bank deposits yet providing a higher yield. They usually pay out interest on a monthly basis, rather than annually, as bank savinsg accounts do. They take the money they have received over the course of a month, invest it, then calculate how much return they managed to get over the course of the month. Over the last 12 months, the best performing money market funds have been able to generate up to 15% per year in interest, compared with 7% from bank savings.

Why Should You invest in a Money Market Fund?

A money market fund is a great place to put your savings - either emergency savings or while saving for something, such as a car or house.

- They are a low-risk, high liquidity method to grow your money. Low risk means you can’t lose the principal amount you put in and your money grows every month. The only risk I see is if the fund collapsed with your money. High liquidity means you can get your money back quickly when you need it (within three working days).

- You earn compound interest not simple interest. So the interest you earn is added to your principal each month and then that new principal earns more interest. Simple interest is calculated on the principal alone, but compound interest is calculated on the principal and interest earned. So for example, for simple interest of 1% for Sh10, 000, the first month you’ll earn Sh100 (1% of the principal 10, 000), the second month you will earn another Sh100 (1% of 10,000), so in total, you’ll have Sh10, 200. But in compound interest, the first time you’ll earn Sh100 (1% of 10, 000) but the next month interest will be calculated as 1% of 10, 000 + 100 (principal plus interest to make new principal). So 1% of 10, 100 = 101. So the second month on compound interest, you’ll have a total of 10, 201. The third month on simple interest you’ll have 10, 300; on compound interest 10, 303. So basically your money grows at a faster rate.

- Your money is invested by professionals to ensure maximum return and low risk.

- You can top up at any time, unlike with a fixed deposit account at a bank where you can’t top up anytime.

- Attractive interest. Although the interest rate fluctuates, you get way better interest than you would in an ordinary bank savings account.

How to invest in Money Market Funds on Abacus

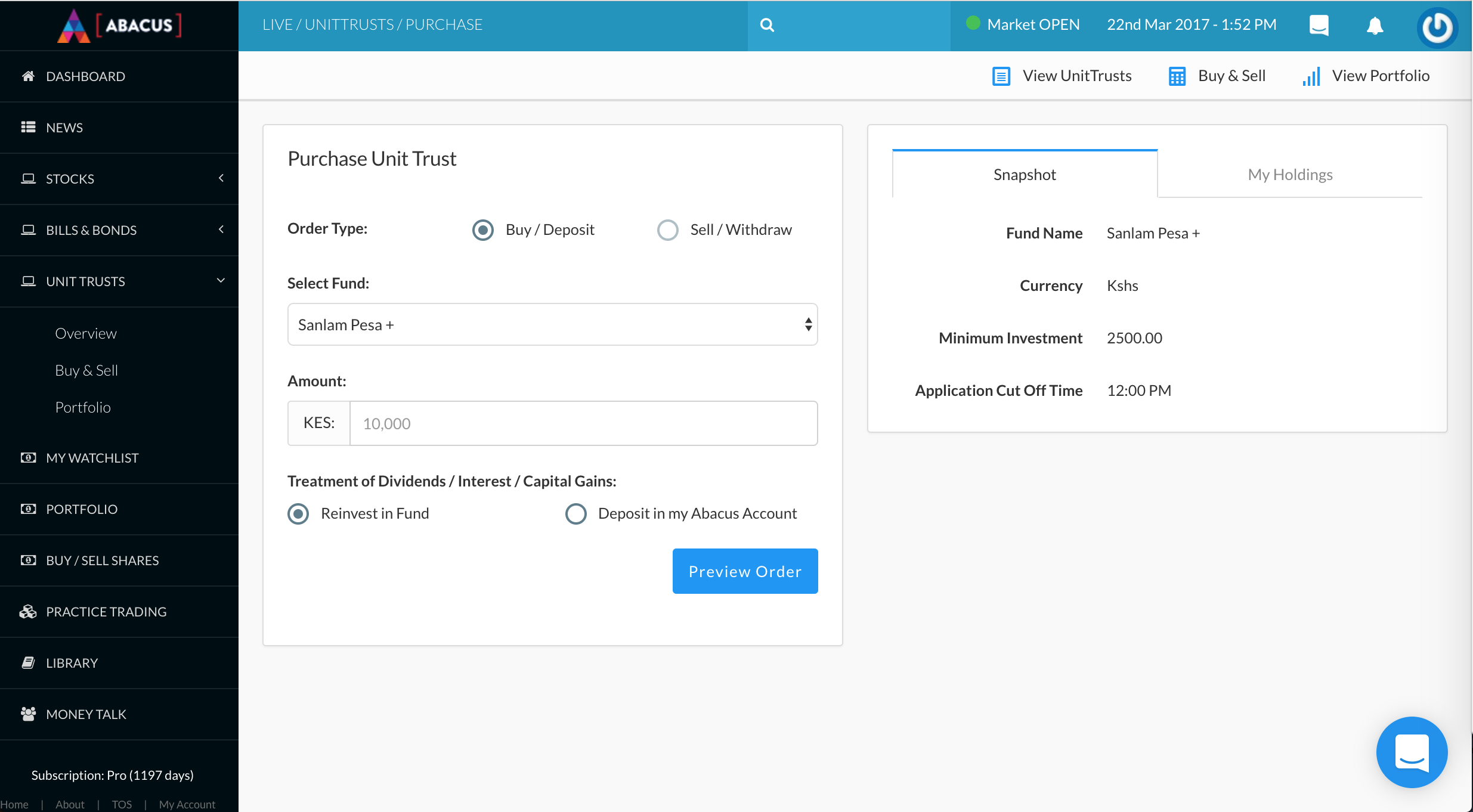

- Click on the Unit Trusts menu on the Sidebar

- Select "Buy and Sell"

- Select "Order Type" as Buy/Deposit

- Select a Fund. Currently, we have Old Mutual and Sanlam Money Market Funds available. Other funds will be added soon.

- Add the amount you would like to invest. The minimum for Sanlam is KES 2,500, for Old Mutual is KES 1,000. You will need to have deposited the money via the options available to you on the "Deposits" page under your "Investment Account" tab.

- Select how you would like the interest treated. You can have it deposited into your Abacus account or reinvested in the fund you have selected.

- The interest earned will be updated on your statement available under your portfolio.

- To withdraw, click on "Sell/Withdraw", select your fund, enter the amount and submit.

- Please allow up to 48 Hours for processing.