Equity runs ahead of rivals with takeover of DRC bank

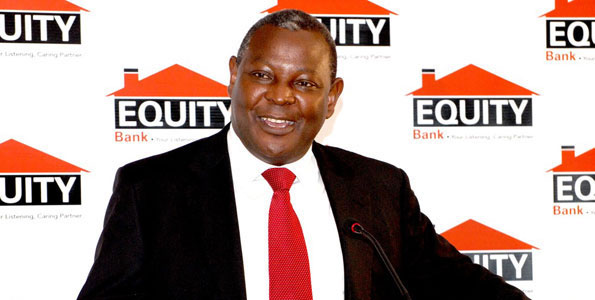

Equity Group has announced plans to acquire a 79 per cent stake in a Democratic Republic of Congo bank, ProCredit Bank, for $60 million (Sh5.8 billion), marking the Kenyan lender’s entry into central Africa. The acquisition is partly being financed by share swaps though the exact number of shares and the strike price were unknown by the time of going to press. Equity’s chief executive James Mwangi said the deal, which is awaiting regulatory approval in Kenya and DRC, is the first of an ambitious Pan African expansion drive that will see it venture into nine more countries […]

CBK discloses the most costly lenders

Central Bank of Kenya has listed a loan pricing for banking sector in bid to promote transparency. The list shows Bank of India as, on average, the cheapest lender followed by the listed NIC Bank. Centum-owned K-Rep and Pakistani-based Habib Bank are the most expensive lenders […]

Dar owners in Sh1.3bn Oriental deal

Tanzanian investors under the M Holdings Group are gunning for a maximum 51 per cent stake in Oriental Commercial Bank intend to change the lender’s name to M-Oriental. In a notice for Oriental annual general meeting—expected to approve the deal—scheduled for June 25, the bank has valued the deal at Sh1.268 billion going by a share price of Sh30. This is the first significant entry of Tanzanian investors in the competitive Kenyan banking industry […]

Sameer eyes Nigeria and Mauritius to boost sales

Tyre maker Sameer Africa is targeting new markets in Africa to boost its sales which have faced stiff competition from cheap Chinese imports. Sameer Africa has identified new markets in Madagascar, Nigeria, Mauritius and Mozambique. The company said it would expand by establishing own outlets as well as local partnerships […]

Slow court process in Kenya impeding war on rogue stockbrokers

Confidence among retail investors remains subdued at the Nairobi Stock Exchange (NSE). This follows failure to prosecute individuals behind collapse of several stock brokerage firms that went under with cash belonging to the public. The suspects who brought down Discount Securities, Nyaga Stockbrokers, Ngenye Kariuki and Francis Thuo and Partners, are still free and none of those suspected have been prosecuted […]