KCB Group 2015 Quarter 1 Results

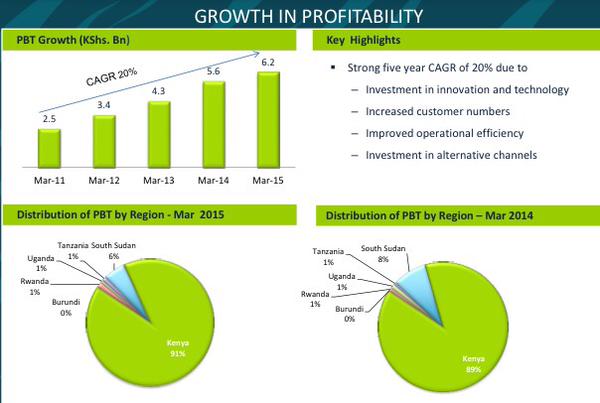

KCB Bank Group saw its Q1 pre-tax profit rise by 12% to KShs. 6.2 Billion on the back of higher interest income, fees and commissions arising from new business lines.

The Group’s CEO, Mr Joshua Oigara said that the growth in profitability from KShs. 5.6 Billion over the same period last year was a result of a sustained push to grow non-funded income, as well as cost management initiatives across Kenya and the International businesses.

The key performance highlights for the Q1 results are:

- Total Assets: Increased by 24% from KShs. 411.4 Billion to KShs 510.3 Billion

- Net Loans and Advances: Increased by 27% from KShs. 233.8Billion to KShs 297Billion

- Customer deposits: Increased by 27% from KShs. 313.5 Billion to KShs 397.1 Billion

- Shareholder Funds: Increased by 19% from KShs. 66.8 Billion to KShs. 79.4 Billion

- Long term debt funding: Increased by 24% from KShs. 10.3 Billion to KShs. 12.7 Billion

- Profit Before Tax: Increased by 12% from KShs 5.6 Billion to 6.2 Billion

- Net Interest Income: Increased by 11% from KShs 8.3 Billion to KShs 9.3 Billion

- Fees and commissions: Increased by 19% from KShs 2.7 Billion to KShs 3.2 Billion

Mr Oigara said that the earnings were as a result of a continued focus on the business to drive up non-funded income. Also, fees and commissions grew by 19% as a result of increased transaction volumes and new products which we have rolled out to meet changing customer.

“This is a confirmation that the catalytic investments we have been putting into the business through partnerships are increasingly bearing fruits. We see the partnership with Safaricom as a game-changer in the financial services sector. For us, such partnerships are meant to make financial services more accessible to the general population,” said Mr Oigara.

The following events happened in Q1:

- In April, KCB formally launched, KCB Insurance Agency. This will initially be available in 98 of the bank’s 187 branches in Kenya before the full roll out across the country and the region in the next 12 months.

- In April, KCB launched its Islamic Banking unit called KCB Sahl Banking that paved the way for the full roll-out of Sharia’h compliant products and supports the financial inclusion agenda.

- Mid-April, KCB Group rolled out a programme aimed at facilitating the collection of taxes across Kenya’s 47 counties. The revenue collection solution is part of the Bank’s wider initiative to enhance service delivery to citizens in the ongoing devolution process.

- In March, KCB launched the KCB M-PESA Account, the second product under the strategic partnership between KCB Group and Safaricom. This will allow customers to access loans based on their credit worth history while also enabling them to save on free deposit accounts and earn interest.

KCB continues to remain strong on all prudential ratios with core capital to total risk weighted at 17.1% (Revised CBK minimum-10.5%), total capital to total risk weighted assets at 18.1% (Revised CBK minimum-14.5%), core capital to total deposits at 21% (Revised CBK minimum-8%) and liquidity ratio at 31.4% (CBK minimum-20%).

KCB Bank Group also appointed the following people:

- Lawrence Kimathi Kiambi -Chief Financial Officer

- Kennedy Ouko Director- Corporate Banking

For more information: